Get the free adp filler

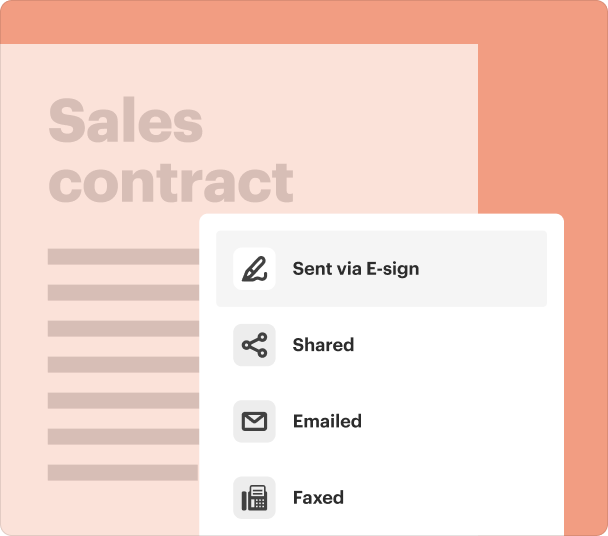

Fill out, sign, and share forms from a single PDF platform

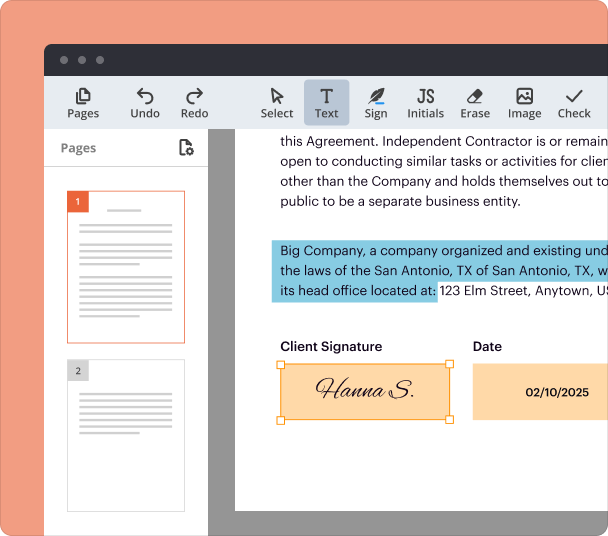

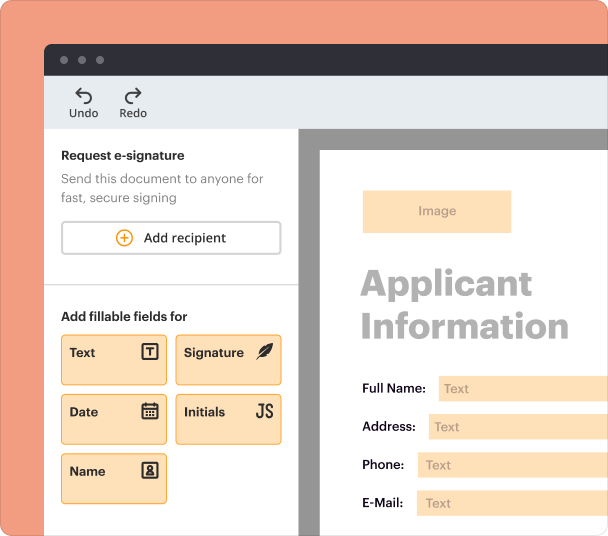

Edit and sign in one place

Create professional forms

Simplify data collection

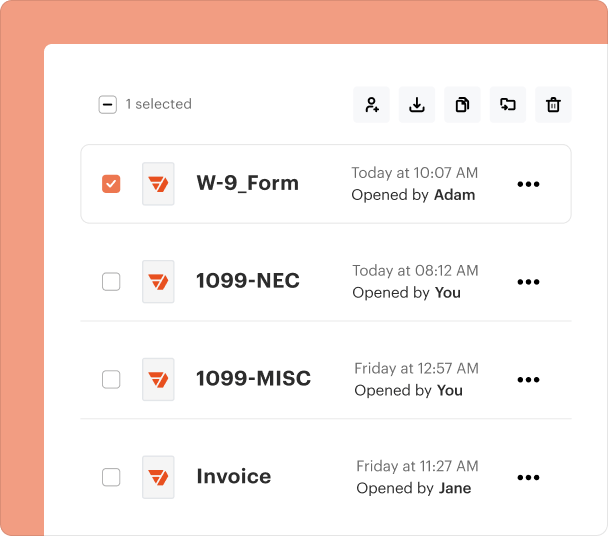

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to the ADP Filler Form

Understanding the ADP Filler Form

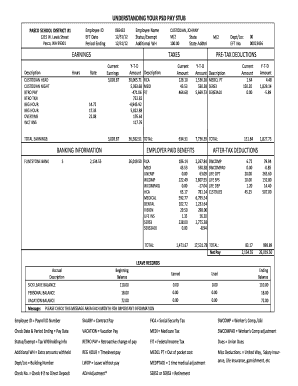

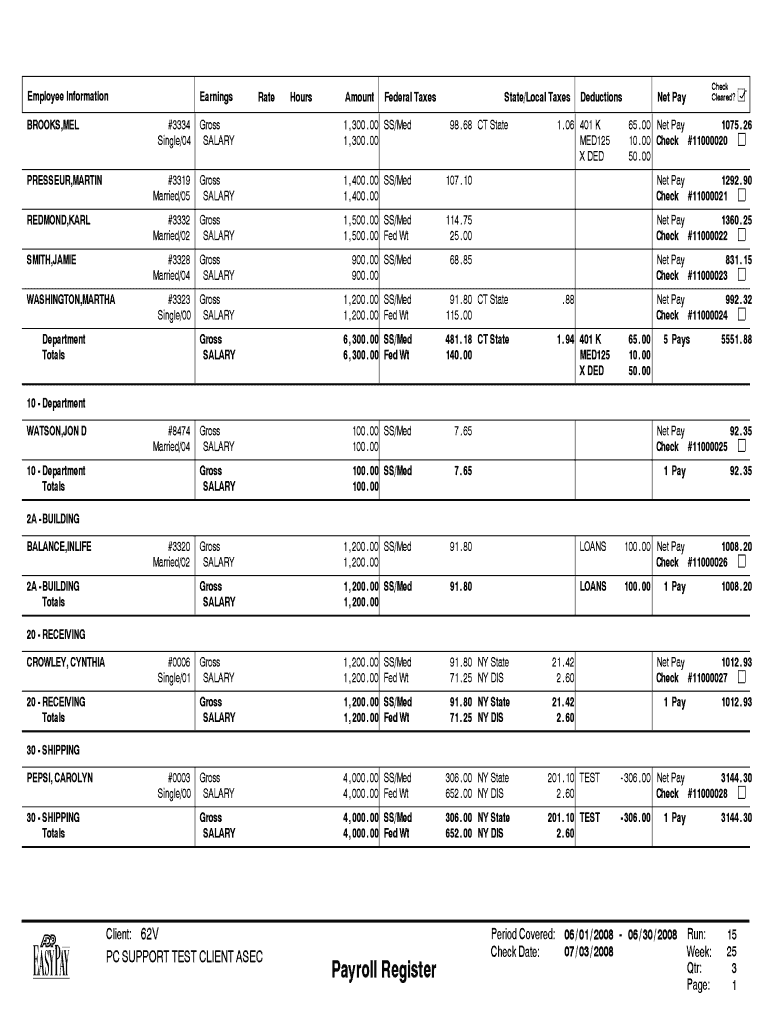

The ADP filler form is a crucial document used primarily within payroll and human resources settings. Designed to collect and organize essential employee information, this form facilitates efficient processing of payroll, benefits, and tax documentation. Employers utilize the ADP filler form to ensure that data is correctly captured and managed, enhancing the accuracy of payroll calculations and compliance with federal regulations.

Key Features of the ADP Filler Form

The ADP filler form boasts several key features that streamline the filling process. These include:

-

The form is structured to be easy to navigate, reducing errors during completion.

-

It gathers all necessary employee information, including personal details, tax information, and benefits preferences.

-

Users can fill out and sign the form electronically, promoting a paperless environment.

Situations Requiring the ADP Filler Form

The ADP filler form is typically needed in various scenarios, including the onboarding of new employees, changes to employee status, and updates to personal or tax information. Whenever an employee's payroll data requires adjustment or verification, this form serves as the primary document to ensure accurate and up-to-date records are maintained.

Essential Information for Completion

To accurately fill out the ADP filler form, certain information is required. This includes:

-

Full name, address, and Social Security number.

-

Position, department, and hiring date.

-

Filing status and dependents.

Best Practices for Completing the ADP Filler Form

To ensure accuracy when filling out the ADP filler form, consider the following best practices:

-

Review all information for errors before submitting.

-

Ensure all information is legible to prevent miscommunication.

-

Retain a copy of the form for personal records.

Common Issues and Their Solutions

Users may encounter various issues while filling out the ADP filler form. Common problems include incomplete fields, incorrect tax information, and submission errors. To address these, take the following steps:

-

Ensure that every required field is filled to avoid incomplete submissions.

-

For questions about tax information, seek advice from a qualified expert.

-

If issues arise during submission, reach out to the HR department for support.

Frequently Asked Questions about adp forms

What is the purpose of the ADP filler form?

The ADP filler form is used to collect necessary information for payroll, benefits, and tax documentation in an organization.

When should an employee fill out the ADP filler form?

Employees should fill out the form during onboarding, when changes occur in their employment status, or when updating personal information.

What information is required to complete the ADP filler form?

Required information includes personal details, employment information, and tax-related data.

pdfFiller scores top ratings on review platforms